- November 21, 2024

how to invest in cryptocurrency

How to invest in cryptocurrency

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. https://tahiti-fishing-center.com/what-is-a-jig-and-how-to-fish-with-it/ These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

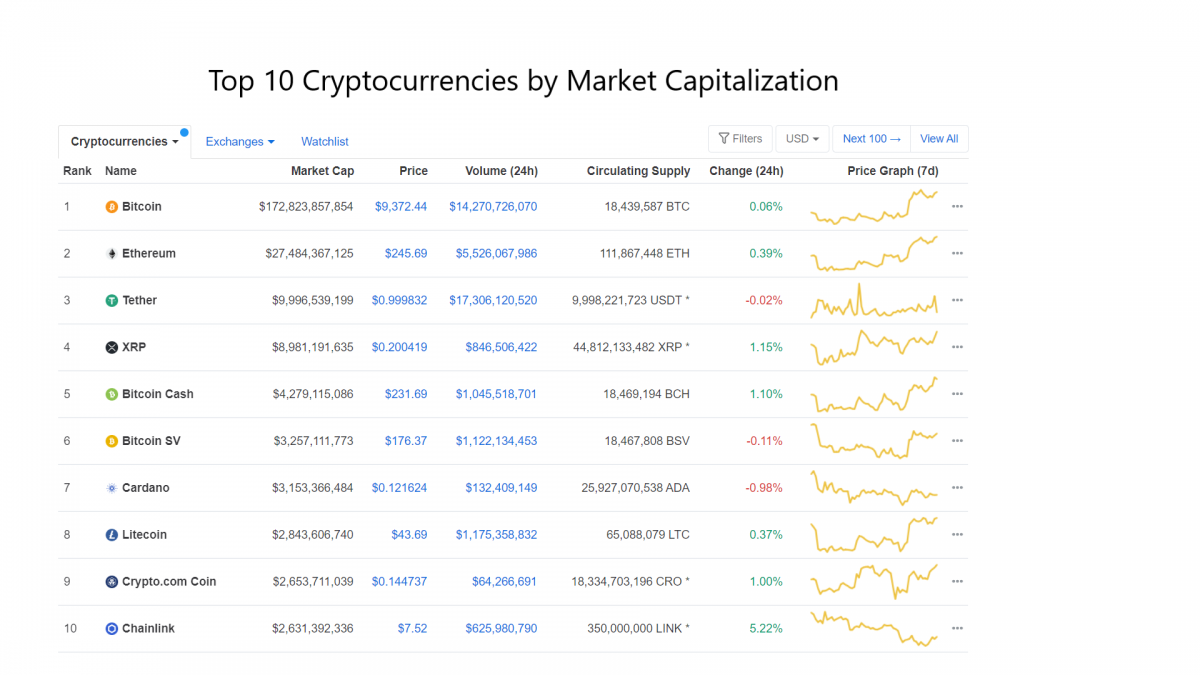

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

China cryptocurrency

These territorial differences, while offering jurisdictional arbitrage opportunities, create uncertainties and increased compliance burden for businesses operating in the sector. This is exacerbated by the absence of common standards and terminologies.

Britain is actively building rules for the crypto sector. Of note, it has mandated that any company offering a digital currency has to be authorized by the country’s Financial Conduct Authority (FCA).

Japan is open to crypto use, recognizing it as a type of money and as legal property. As such, crypto and yen transactions are both managed by the country’s Financial Services Agency, and citizens of the country are free to own or invest in crypto. The country has recently toughened its rules on sharing customer information between crypto exchanges, in an attempt to tackle money laundering.

These territorial differences, while offering jurisdictional arbitrage opportunities, create uncertainties and increased compliance burden for businesses operating in the sector. This is exacerbated by the absence of common standards and terminologies.

Britain is actively building rules for the crypto sector. Of note, it has mandated that any company offering a digital currency has to be authorized by the country’s Financial Conduct Authority (FCA).

How does cryptocurrency work

The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services. You may obtain access to such products and services on the Crypto.com App.

Cryptocurrencies have the potential to provide financial services to unbanked and underbanked populations. With just an internet connection, individuals can access and use cryptocurrencies, bypassing the need for traditional banking infrastructure.

Cryptocurrencies are not controlled by the government or central regulatory authorities. As a concept, cryptocurrency works outside of the banking system using different brands or types of coins – Bitcoin being the major player.

:max_bytes(150000):strip_icc()/dotdash-price-cryptocurrencies-totally-dependent-china-v2-14aba0989209430da6692d4e6cbb7ee6.jpg)