- November 14, 2024

Online casino

Online casino

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. https://www.lexaloffle.com/bbs/?uid=107114 Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

As the first big Wall Street bank to embrace cryptocurrencies, Morgan Stanley announced on 17 March 2021 that they will be offering access to bitcoin funds for their wealthy clients through three funds which enable bitcoin ownership for investors with an aggressive risk tolerance. BNY Mellon on 11 February 2021 announced that it would begin offering cryptocurrency services to its clients.

CoinMarketCap biedt geen financieel advies of beleggingsadvies over welk(e) cryptocurrency, token of activum wel of geen goede belegging is, noch geven we advies over het juiste moment om te kopen of verkopen. We zijn strikt een bedrijf dat gegevens deelt.

In June 2021, El Salvador became the first country to accept bitcoin as legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. Despite the term that has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdicitons, including classification as commodities, securities, and currencies. Cryptocurrencies are generally viewed as a distinct asset class in practice. Some crypto schemes use validators to maintain the cryptocurrency.

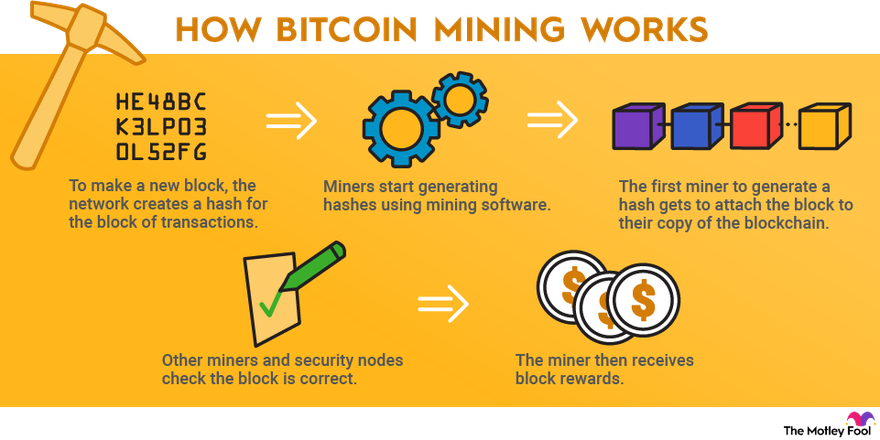

What is cryptocurrency mining

A block header acts as an identifier for each individual block, meaning each block has a unique hash. When creating a new block, miners combine the hash of the previous block with the root hash of their candidate block to generate a new block hash. They must also add an arbitrary number known as a nonce.

The competition between these blocks continues until the next block is mined on top of one of the competing blocks. When a new block is mined, whichever block came before it is considered the winner. The block that is then abandoned is called an orphan block or a stale block, which causes all the miners who picked that block to switch back to mining the chain of the winning block.

Mining pools are groups of miners who pool their resources (hash power) to increase their chances of winning block rewards. When the pool successfully finds a block, the miners in the pool share the reward according to the amount of work they each contributed.

A block header acts as an identifier for each individual block, meaning each block has a unique hash. When creating a new block, miners combine the hash of the previous block with the root hash of their candidate block to generate a new block hash. They must also add an arbitrary number known as a nonce.

The competition between these blocks continues until the next block is mined on top of one of the competing blocks. When a new block is mined, whichever block came before it is considered the winner. The block that is then abandoned is called an orphan block or a stale block, which causes all the miners who picked that block to switch back to mining the chain of the winning block.

China cryptocurrency

New applications and models such as tokenization, decentralized finance, NFTs (non-fungible tokens) and decentralized autonomous organizations challenge traditional models that outline who is currently considered a “person,” what is “value” and how this “value” can be transacted. This threatens to come into direct conflict with existing regulations pertaining to cross-border data flows, intellectual property rights and capital controls. It could also lead to ambiguity in the taxation environment, as well as posing a host of other policy concerns.

Britain is actively building rules for the crypto sector. Of note, it has mandated that any company offering a digital currency has to be authorized by the country’s Financial Conduct Authority (FCA).

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

New applications and models such as tokenization, decentralized finance, NFTs (non-fungible tokens) and decentralized autonomous organizations challenge traditional models that outline who is currently considered a “person,” what is “value” and how this “value” can be transacted. This threatens to come into direct conflict with existing regulations pertaining to cross-border data flows, intellectual property rights and capital controls. It could also lead to ambiguity in the taxation environment, as well as posing a host of other policy concerns.

Britain is actively building rules for the crypto sector. Of note, it has mandated that any company offering a digital currency has to be authorized by the country’s Financial Conduct Authority (FCA).

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.