- November 21, 2024

cryptocurrency

Cryptocurrency

The native token of the Solana platform is called SOL, and is used for paying transaction fees, staking, and participating in governance decisions on the network. The ICO price for SOL was $US0.2 bridal golden goose 2, and as of September 24, 2024, now sits at $US146, an increase of 66,263%.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Rae Hartley Beck first started writing about personal finance in 2011 with a regular column in her college newspaper as a staff writer. Since then she has become a leader in the Financial Independence, Retire Early (FIRE) movement and has over 300 bylines in prominent publications including Money, Bankrate and Investopedia on all things personal finance. A former award-winning claims specialist with the Social Security Administration, Rae continues to share her expert insider knowledge with Forbes Advisor readers.

Buying cryptocurrency doesn’t grant you ownership over anything except the token itself; it’s more like exchanging one form of currency for another. If the crypto loses its value, you won’t receive anything after the fact.

Given the thousands of cryptocurrencies in existence and the high volatility associated with most of them, it’s understandable you might want to take a diversified approach to investing in crypto to minimize the risk that you might lose money.

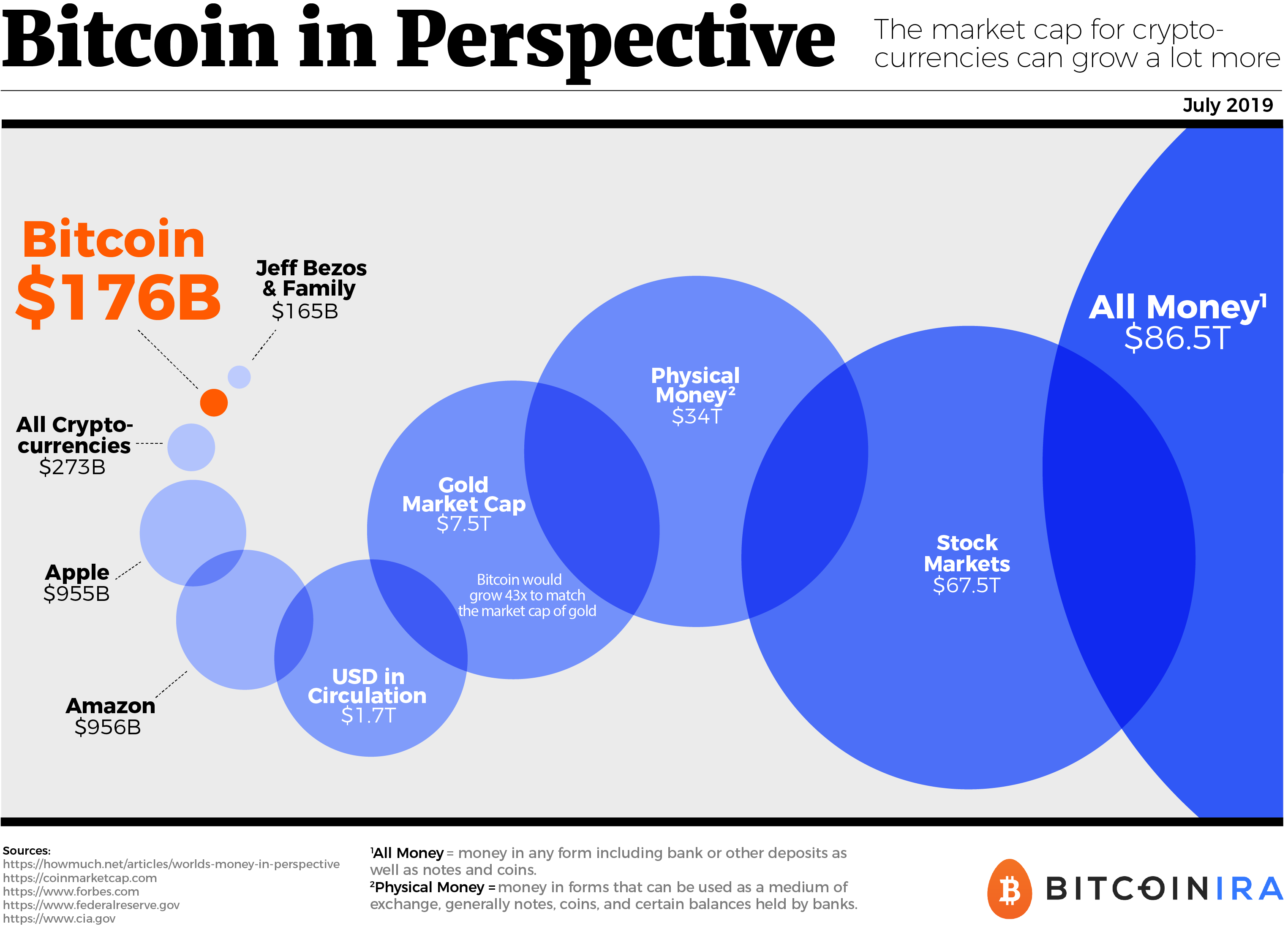

Cryptocurrency market cap

In an interview for CoinMarketCap’s Crypto Titans series, Hoskinson said that he got involved in cryptocurrencies back in 2011 — and dabbled in mining and trading. He explained that his first professional involvement in the industry came in 2013, when he created a course about Bitcoin that ended up being taken by 80,000 students.

Parameters:• time_start: (optional) Timestamp (Unix or ISO 8601) to start returning quotes for. Example: 2024-01-01T00:00:00Z.• time_end: (optional) Timestamp (Unix or ISO 8601) to stop returning quotes for. Example: 2024-10-01T00:00:00Z.• interval: Interval of time to return data points for. Example: 1d, hourly, weekly, monthly.• count: (optional) The number of interval periods to return results for. Example: 100.• convert: (optional) Optionally calculate market quotes in up to 3 other fiat currencies or cryptocurrencies. Example: convert=USD,EUR,BTC.• convertid: (optional) Use CoinMarketCap IDs instead of symbols for conversions. Example: convertid=1,2781.Response Example:

Another point that Bitcoin proponents make is that the energy usage required by Bitcoin is all-inclusive such that it encompasess the process of creating, securing, using and transporting Bitcoin. Whereas with other financial sectors, this is not the case. For example, when calculating the carbon footprint of a payment processing system like Visa, they fail to calculate the energy required to print money or power ATMs, or smartphones, bank branches, security vehicles, among other components in the payment processing and banking supply chain.

In an interview for CoinMarketCap’s Crypto Titans series, Hoskinson said that he got involved in cryptocurrencies back in 2011 — and dabbled in mining and trading. He explained that his first professional involvement in the industry came in 2013, when he created a course about Bitcoin that ended up being taken by 80,000 students.

Parameters:• time_start: (optional) Timestamp (Unix or ISO 8601) to start returning quotes for. Example: 2024-01-01T00:00:00Z.• time_end: (optional) Timestamp (Unix or ISO 8601) to stop returning quotes for. Example: 2024-10-01T00:00:00Z.• interval: Interval of time to return data points for. Example: 1d, hourly, weekly, monthly.• count: (optional) The number of interval periods to return results for. Example: 100.• convert: (optional) Optionally calculate market quotes in up to 3 other fiat currencies or cryptocurrencies. Example: convert=USD,EUR,BTC.• convertid: (optional) Use CoinMarketCap IDs instead of symbols for conversions. Example: convertid=1,2781.Response Example:

Best cryptocurrency

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

From bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, which can make it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies to invest in based on their market capitalization or the total value of all the coins currently in circulation.

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralized applications, which ADA, its native coin, powers.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

From bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, which can make it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies to invest in based on their market capitalization or the total value of all the coins currently in circulation.

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralized applications, which ADA, its native coin, powers.